Declining balance method calculator

Things to note in the above calculation. The declining balance technique represents the opposite of the straight-line depreciation method which is more suitable for assets whose book value drops at a steady.

Declining Balance Method Of Depreciation Formula Depreciation Guru

Our online tools will provide quick answers to your calculation and conversion needs.

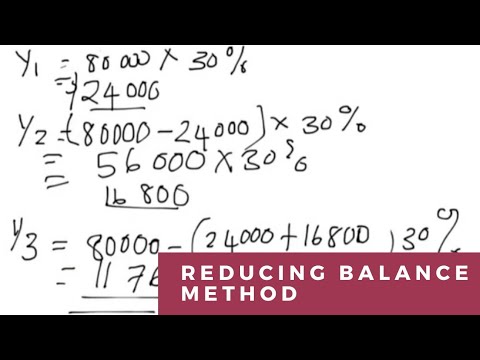

. Use this calculator to calculate variable declining balance depreciation. The declining balance method of Depreciation is also called the reducing balance method where assets are depreciated at a higher rate in the initial years than in the subsequent years. Declining Balance Depreciation Calculator Choose declining rate calculate the depreciation for any chosen period and create a declining balance method depreciation schedule.

The macrs depreciation calculator is specifically designed to calculate how fast the value of an asset decreases over time. The variable declining balance calculation is a combined. This is a type of calculation allowed under MACRS.

The total interest payable calculation is simple. In this video Ill show you how to solve for the book value and total depreciation related to one of the depreciation methods Declining Balance Method wit. But on downside this.

The loan calculations will be as below. For example choosing 2 would be the same as the double declining method or. Depreciation Factor - When choosing the declining balance this is the rate at which the asset will be depreciated.

Declining Balance Depreciation Calculator. Double declining balance method is the method which uses assets that lose value in the early years or if the owner wants to enjoy the tax benefits early. Declining balance depreciation is a method of calculating the depreciation which uses the depreciation rate against non-depreciated balance.

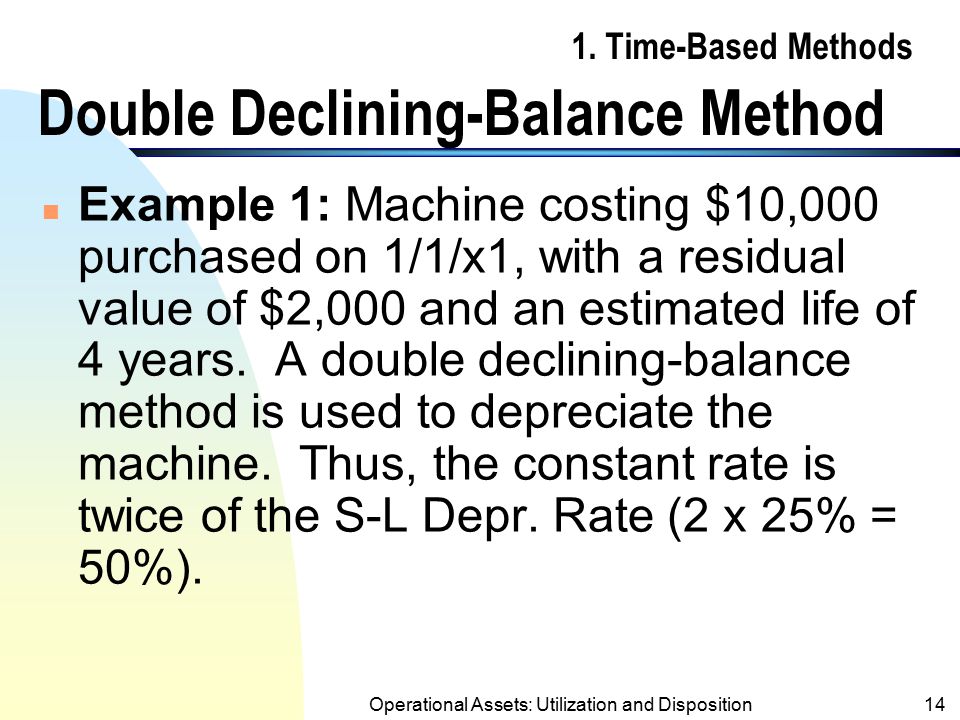

Well you can use this tool to compare three different models of. In this method the depreciation amount. Depreciation per year Book value Depreciation rate Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice.

Dual Declining Balance Method is one of the sped-up techniques utilised for the estimation of the deterioration add up to be charged in the pay articulation of. On this page you can calculate depreciation of assets over. The straight line depreciation rate 100 5 20 Double Declining Depreciation Rate 2 Straight Line Depreciation Rate 220 40 The depreciation using double.

How To Use The Excel Ddb Function Exceljet

Declining Balance Depreciation Calculator

Double Declining Balance Depreciation Daily Business

What Is The Double Declining Balance Depreciation Method Quora

Straight Line Method Vs Diminishing Balance Method Depreciation Calculation Examples Youtube

Declining Balance Method Of Depreciation Examples

Fixed Assets

Declining Balance Method Definition India Dictionary

Double Declining Balance Depreciation Calculator Double Entry Bookkeeping

Declining Balance Depreciation Schedule Calculator Double Entry Bookkeeping

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

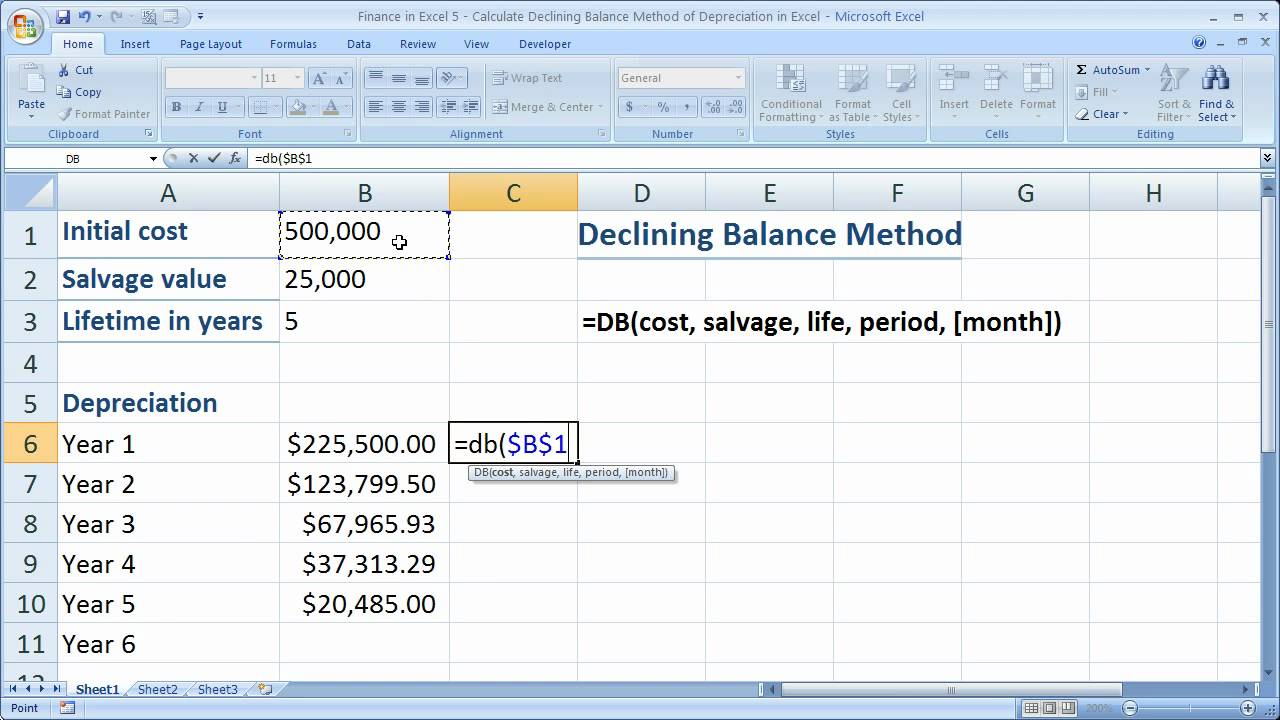

Finance In Excel 5 Calculate Declining Balance Method Of Depreciation In Excel Youtube

Double Declining Balance Depreciation Method Youtube

Double Declining Depreciation Efinancemanagement

Depreciation Formula Calculate Depreciation Expense

How To Calculate Depreciation Using The Reducing Balance Method Diminishing Balance Method Youtube

How To Use The Excel Db Function Exceljet